Aransas County Title recently stopped a fraudster cold and became the latest Alliant National Crime Watch recipient

By Adam Mohrbacher

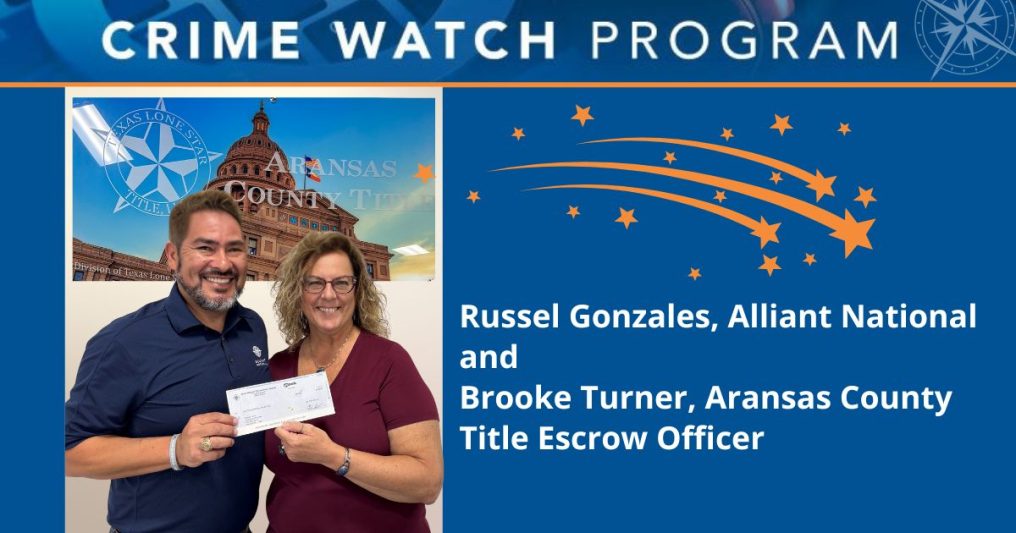

In the title industry, transaction security can never be secondary. When critical details are overlooked or due diligence is skipped, there can be real consequences for real people. It is for those reasons and more that Alliant National created its Crime Watch program, which rewards agents for going above and beyond to detect and deter fraud. Alliant National agent Aransas County Title became the latest recipient of the award when it stopped a dubious cash deal from closing. Read on to see why strong anti-fraud protocols can make all the difference in moments like these.

Having been in the title industry since 2008, Aransas County Title Escrow Officer Brooke Turner has worked on countless transactions over the course of her career. She knows all the hallmarks of a legitimate transaction, as well as the warning signs that not everything is on the up-and-up. When a contract for a $250,000 property came across her desk, Turner found elements of both. On the plus side, Aransas County Title knew the seller, having handled the purchase of her new home. Yet, some details about the buyer didn’t sit quite right. “The buyers were young and not married, so that was already a red flag because they told us they had not been together too long,” Turner told us. “They also said they were ‘coming into money,’ which is something nobody says.”

Things then got weirder. A woman claiming to be the buyer came in to drop off a $10,000 check—an “amount of earnest money that was a little higher than what we typically see for that sales price.” The check also wasn’t from her own account but from one belonging to her grandmother. The woman insisted everything was fine, but Turner and the rest of the Aransas County Title team were far from convinced. Scrutinizing the check, they noticed the handwriting matched the handwriting on the contract. It appeared that the buyer had actually signed her grandmother’s name.

They decided to verify with the issuing bank, which unsurprisingly reported that the account associated with the check had been closed. The bank reached out to the holder of the now closed account, who stated that she had not actually issued the check and was unaware of any contract. The account holder did say that the woman who dropped off the check was her granddaughter, but that she had been taken off the account due to misuse of funds. That was all the evidence Aransas County Title needed to cancel the contract, leaving any legal action up to the grandmother.

In the aftermath of the fraudulent transaction, Turner was left with mixed emotions. “It made me mad that this type of thing occurred. But I was very happy that we noticed the red flags and put a stop to the transaction.” The experience also reinforced the need for agencies to continue practicing strident anti-fraud measures as part of their daily workflows. At Aransas County Title, Turner explained, “We look at everything associated with identities and banking accounts—including handwriting. If the handwriting on recorded documents doesn’t match the contract or wiring instructions, it’s a huge red flag.”

Again, the experience highlighted the necessity for the title industry to band together to curtail fraud. It is only through collaboration and innovation that meaningful progress can be made. Aransas County Title already does this by utilizing identity verification tools provided by its underwriter, Alliant National, whenever they need to vet and verify suspicious transaction details. “We double check ID info and banking info through the SecureMyTransaction program and verbally to verify identities and accounts,” she said.

Fraud in the title industry is not going away, at least not any time soon. But with agents like Turner and agencies like Aransas County Title in the mix, fraudulent deals can still be stopped well before they close. By leveraging a mixture of tried-but-true anti-fraud measures and cutting-edge technology, they were able to prevent loss and protect transaction stakeholders. And their experiences offer important insights for any professional wanting to apply the same rigor and care to their own contracts.

Want to learn more about Alliant National’s Crime Watch program? Start here. You can also check out SecureMyTransaction and schedule a free demo for your agency.